Zakhil Suresh, an aspiring chartered accountant in Kodungallur, a small port town on the Malabar coast in Kerala, has a nose for investment opportunities. Suresh, 23, was an early entrant into the swirling world of Bitcoins, a so-called cryptocurrency that is taking the world by storm — it has appreciated about 33 million times since 2009, when it was established.

An investing enthusiast, Suresh had put down nearly Rs 1 lakh buying into Bitcoins two summers ago but had run into a wall with the investment. The New Delhi company he had entrusted the money — that he and two friends borrowed from parents or pulled out of savings — with had seemed to have swallowed it. Despite a spirited pursuit that publicly named and shamed the company, GainBitcoin, it had refused to return Team Suresh’s money for nearly 25 months.

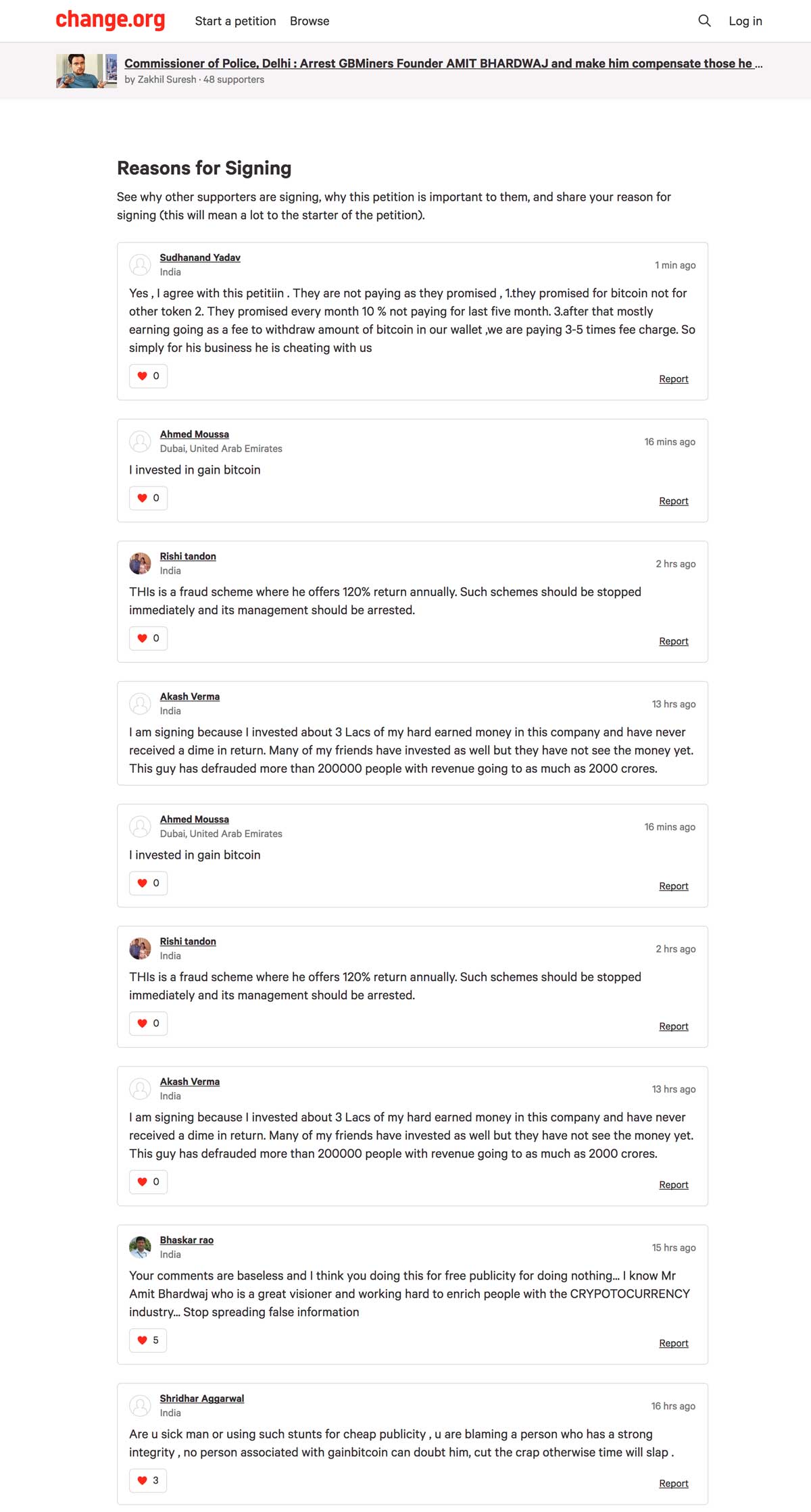

Curiously, after all these months, Suresh got a call on July 29 from a man who claimed to be GainBitcoin promoter from Malappuram in North Kerala. This person made Suresh a proposition — he’d settle the pending dues if he (Suresh) and his friends pull back a petition made on Change.org that asked the Delhi Police to investigate GainBitcoin and Bhardwaj for fraud. The petition, which got over 100 sign-ups, was appearing on Google searches and affecting the chances of the GainBitcoin promoter in Kerala.

Suresh immediately connected with his friends in the GainBitcoin investment made in June 2015. “This guy has offered to cover our losses and dues on the condition that we take down our Change.org petition. He’s even agreed to settle mutually agreed upon dues and conditions,” he told them. (Suresh won’t divulge the promoter’s name.) Suresh and friends discussed with their parents and it was agreed that they would settle for six Bitcoins. That was their original investment made in June 2015, though the value now was about Rs 12 lakh thanks to the bull run in the cryptocurrency.

Team Suresh had a key condition: the settlement would be made by GainBitcoin, not the Kerala promoter. This is what sunk the deal. At first, the Kerala promoter agreed to the condition. But the next day he said he personally would make good Suresh and friends’ dues, not via GainBitcoin. This was not acceptable to Suresh and his friends. Bitcoin has been in the news for all the wrong reasons — money laundering, ransom, and even theft. On August 9, a person claiming to be a Citibank customer wrote on Reddit that his or her account had been closed over a Bitcoin transaction. Team Suresh wanted everything to be kosher.

FactorDaily has not been able to get GainBitcoin’s reaction yet. Calls to Amit Bhardwaj, GainBitcoin’s founder and CEO, didn’t go through. A request for an interview in an email with questions was unanswered. A spokesperson said twice on phone and text that he would respond but at the time of publishing this story, there was no word from him. We will update this story when we hear from Bhardwaj or GainBitcoin.

Cryptocurrencies are on the rise. Indians don’t want to miss out on the opportunity, especially given how loosely regulated Bitcoins and other currencies are. The Reserve Bank of India and the Securities and Exchange Board of India, the country’s banking and markets regulators, have left cryptocurrencies more or less unregulated. More on regulation later.

Add to this scenario, the demonetization decision of the central government last November that was aimed in part at flushing out black money from the economy. The central finance ministry estimated some 1.8 million citizens had deposited into the banking system amounts that were out of sync with their tax profiles.

It presented a perfect situation for Bitcoins and its peddlers in India. After demonetisation there was a spike in demand for Bitcoins in India — both on and off exchanges. There were a lot more requests to buy BTC than sell them and Bitcoin traded nearly 10% higher in India versus international markets.

There were dodgy investment schemes in the market built on cryptocurrencies even before, to be sure, but demonetization turbo charged them — with companies and their networks doubling down on marketing, customers coming into them in hordes, financial consultants exploiting loopholes to help people convert currency notes into Bitcoins and other cryptocurrencies etc.

Many fell victim to scams some as recent as spring this year. Even though law enforcement and other organisations are in the know about such scams, the rate at which they are popping up makes it very difficult to track and nab the people behind such schemes.

According to a news report, the Mumbai Police was able to nab the operators of one such scam that goes by the name of OneCoin. As part of the operation, 23 people were arrested and the chargesheet states that the promoters amassed nearly Rs 75 crore through the scheme.

But this was just one of the many such schemes that have been floating around in India’s cryptocurrency ocean. Several of them operate under the radar by trying to legitimise their operations via sponsored posts in mainstream media and celebrity endorsements. GainBitcoin and Bhardwaj, for instance, have taken out large advertisements in national dailies. Bhardwaj’s book Crypto Currency for Beginners has been even endorsed by Bollywood actors Shilpa Shetty, Bipasha Basu, Prachi Desai, Neha Dhupia, and Madhavan.

The experience of Suresh, the Kodungallur accounting student who is still bitter about his experience with GainBitcoin, gives a peek into the dark and turbid world of cryptocurrency investing in India.

Early in 2015, Suresh, while doing his articleship in Kochi, and his friends Asif Kattakath and Vishnu V K had got interested in Bitcoins. To understand Bitcoin investing in India better they got in touch with an acquaintance. “We got in touch with Abhishek Bhandari, whom he knew from a previous venture. He asked us to come over to Delhi and said that he will introduce us to Amit Bhardwaj who can help us with Bitcoins,” says Suresh.

Bhardwaj owned and operated GainBitcoin, a company that claims to operate a cloud mining service. Cloud mining is a method of Bitcoin mining that utilises remotely located mining hardware. This way users do not have to maintain and manage the hardware that usually requires continuous power and cooling. GainBitcoin says that its Bitcoin mining farms are located remotely in China and investors from across the world can use the hardware without having to own and maintain it.

According to Suresh, Bhandari was then working with GainBitcoin and booked the three on Jet Airways to Delhi on June 18, 2015 to meet with Bhardwaj. Suresh recalls landing in Mumbai (they had to change planes there) in the peak of the monsoon season. “It was raining heavily in Mumbai and it was flooding there and it was all over the news,” he says. They weren’t worried — rains are generally seen as a harbinger of good times in Kerala, like in other parts of India.

Even though they had a basic idea of cryptocurrencies, Suresh and his friends did not know much about Bitcoins so they carried printouts of the Bitcoin whitepaper to read. “ We were reading the whitepaper on the way to the airport, in the flight and even on the way to meet Bhardwaj,” Suresh recalls.

They reached Delhi late afternoon and Bhandari was at the airport to pick them up. “He (Bhandari) drove us to GainBitcoin’s office in Delhi but our meeting with Bhardwaj was scheduled for the next day. I don’t remember the exact location of GainBitcoin’s office but it was next door to the Bitex office, a Bitcoin exchange which was also one of Bhardwaj’s companies,” Suresh says. It was the first trip of the Kodungallur boys to the capital. According to Bitex’s website, its India office is located at Ansal Bhavan on KG Marg near Connaught Place in New Delhi.

On the morning of the day of the meeting with Bhardwaj, Suresh got a call from his Kochi office for some work, so the meeting had to be postponed to the afternoon. “We reached the office and met with Bhardwaj in his cabin. After the meeting Bhardwaj left and we had a nice lunch in the cabin that Bhandari had organised for us,” he adds.

Suresh recollects not having a great first impression of Bhardwaj but with the build up about his expertise in the field given by Bhandari, whom they trusted, they were convinced. “Bhardwaj went on to explain his company’s next five year plan, how they make profits, its products and all.”

According to Suresh, Bhardwaj said that GainBitcoin is registered in Singapore and the Delhi office was just for operations. When asked how the company makes profits, Bhardwaj explained that GainBitcoin buys mining machine using the payments from investors. For a period of 18 months of a contract, the mining income goes to the investor and from the 19th month the income stays with GainBitcoin as its profits.

Being a CA student, Suresh was curious about how the company handles taxes. “He (Bhardwaj) told us that all transactions happen in Bitcoins through Bitex. What goes in is Bitcoins and what comes out is Bitcoins so there is no involvement of INR that way we don’t have to deal with taxes,” says Suresh.

After the meeting, Team Suresh stayed back in Delhi for a day and then returned home. After a discussion, they planned to invest in Bitcoins through GainBitcoin. “At that time the price of Bitcoin was around Rs 16,000 and GainBitcoin was offering something called a Matrix plan. There will be one contract and five other contracts under the main contract. So, we opened six positions, one main and the other five under that and we were all under Abhishek Bhandari,” says Suresh. (See How the GainBitcoin MLM network worked’ graphic.)

An MLM (short for multi level market) scheme works like this: any person enrolled has to bring in a pre-specified number of people on to the network and earns commission based on the sales that those people bring in. Each of them, in turn, have to enroll a set of people and so on. Think of an MLM network as a large pyramid being built out. The persons who benefit most from this structure are the ones towards the top end of the pyramid. The operations at companies such as Amway and Tupperware are structured like MLM networks or variants.

Suresh was familiar with the MLM structure at GainBitcoins and his plan was that if they take six accounts and keep one as the primary account and open the other five under the main account, the team will be able to make additional referral income and monthly mining incentives from referral to the main account.

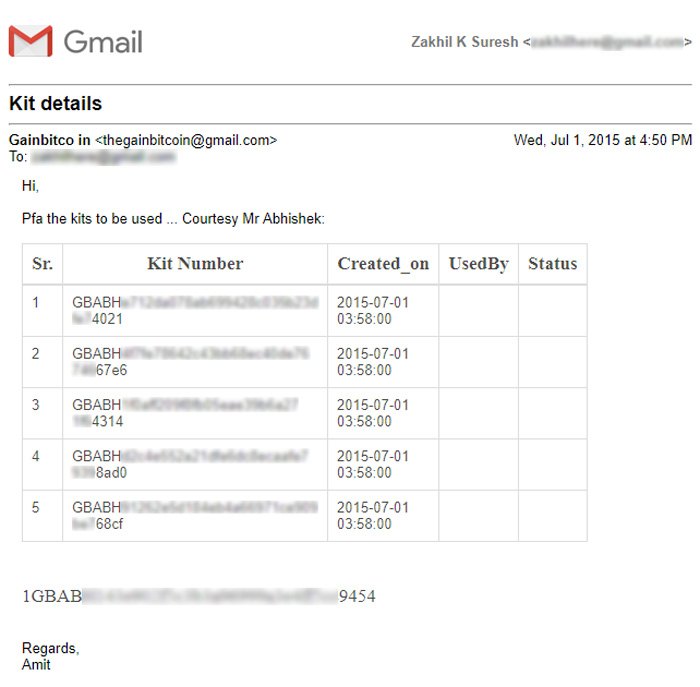

“We paid Rs 98,000 via two bank transactions to Abhishek Bhandari under whom we had registered. And being an MLM scheme we make direct payment to our upline and not directly to the company. The payment to GainBitcoin was to be made in Bitcoins and Abhishek transferred six BTC on our behalf to GainBitcoin with the money we paid him. After this, we received activation kits for six contracts worth 1 BTC each via email from GainBitcoin,” says Suresh.

FactorDaily has seen screenshots of electronic transfers made to Bhandari. The only proof that Suresh has that Bhandari transferred the BTCs to GainBitcoin is a July 1, 2015 mail he received from a GainBitcoin ID on Gmail.

Bhandari responded to a FactorDaily request on Facebook Messenger for comment saying he is on holiday until August 16.

According to Suresh, he and his friends had invested in contracts worth 1 BTC each and valid for 18 months. Once this contract is activated, every month the contract owner is to be paid around 10% of the contract value as mining income, i.e 0.1 BTC and in the end of 18 months they would have accumulated BTC, which in this case was a total of 1.8 BTC. Also being an MLM scheme, which Suresh says he was aware of it being, they would also receive additional income from referrals. This is the reason for Suresh holding one top account and five other accounts under that so that incentives from the other five accounts will also add up to their returns in the top account.

Suresh recalls Bhardwaj promising them three kinds of incomes — mining income, an one-time referral incentive, and a monthly mining bonus from referral accounts — but after a few days he began seeing some disparity between what was promised and what was reflecting in his account. “We then contacted Bhandari about the disparity and was assured that he will talk to Bhardwaj and sort this out. He later informed us that Bhardwaj was not available as he had gone to China for some work at the mining farm,” says Suresh.

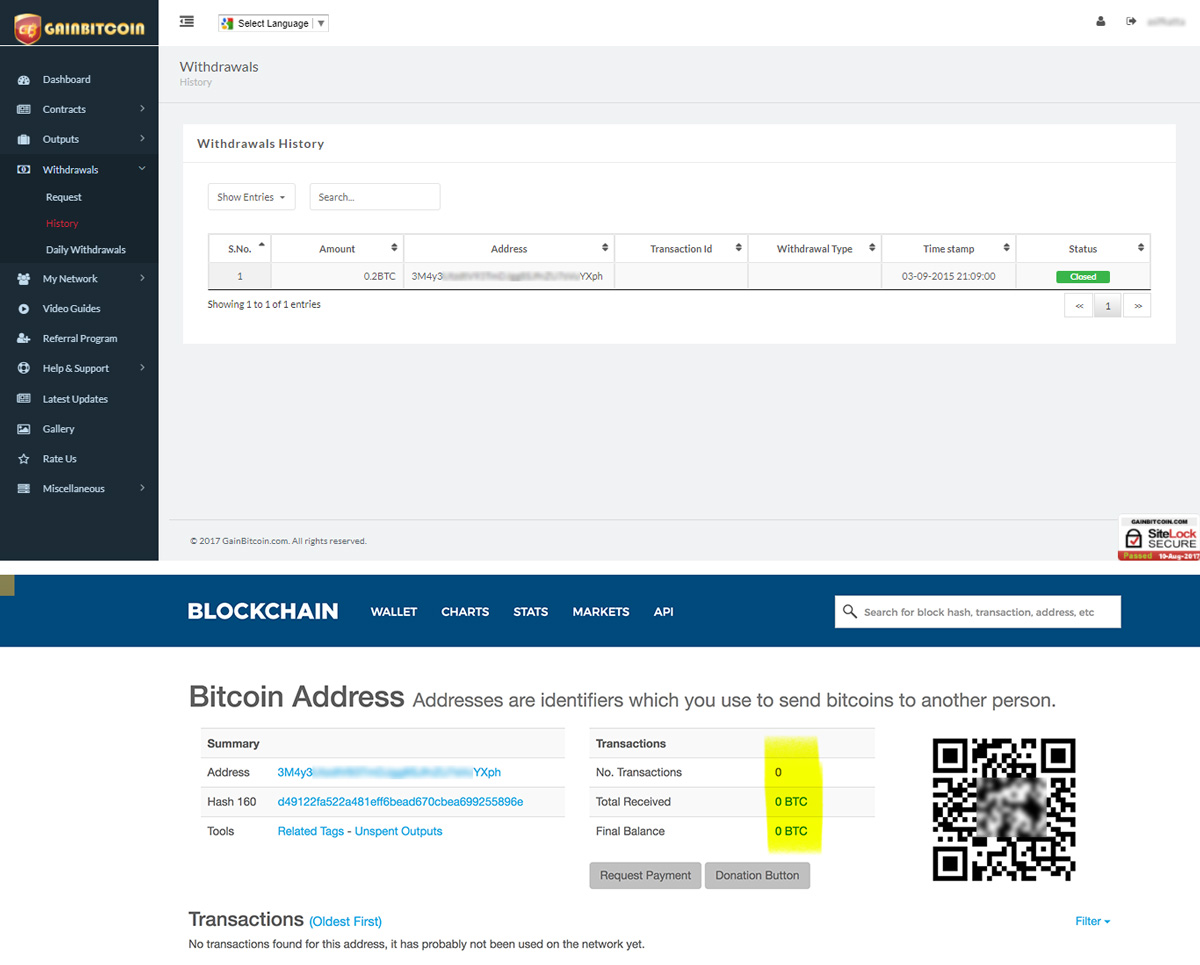

Sometime in August 2015, Suresh tried making some withdrawals from his GainBitcoin income into his private wallet but was unable to do as the service was down for maintenance. “Later we tried again on September 3rd, to withdraw around 0.2 Bitcoins from the top account and provided a Blockchain.info wallet details for it and even after a couple of days the transfer did not happen and the status was shown as pending,” adds Suresh.

In today’s time, with the increase in transaction numbers, a wallet transfer like what Suresh did could take up to half an hour but in 2015 when Suresh had attempted the transfer it should have had happened faster given the fewer number of transactions. The transfer to Suresh’s private wallet should’ve happened sooner than a day or two, but that was not the case.

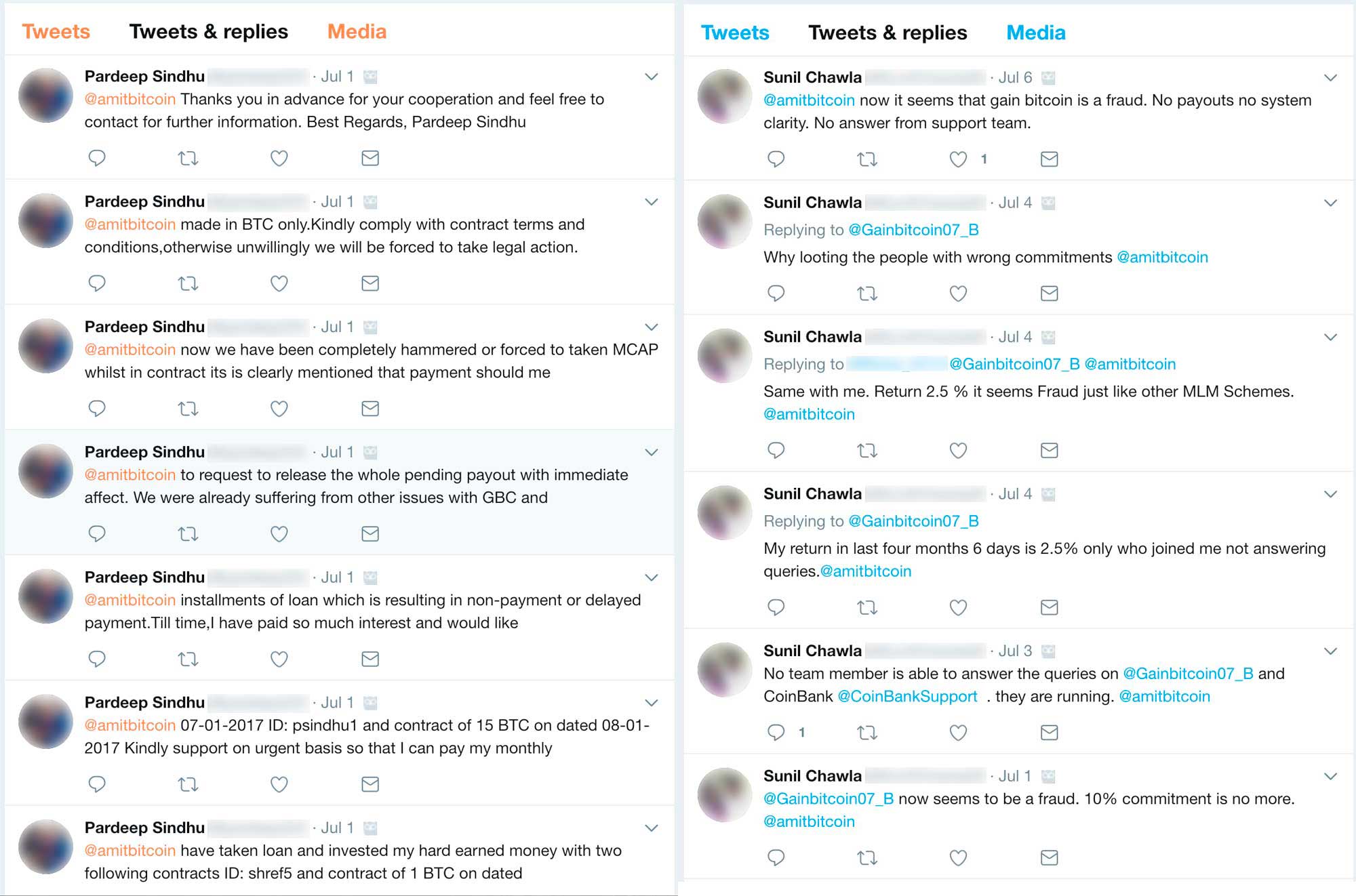

Suresh contacted the GainBitcoin’s support team via email but had no luck.

Missing or delayed support seems to be a common crib among investors complaining across GainBitcoin’s social media channels.

The transfer status continued to be shown as pending on the dashboard and Suresh decided to ignore this for a while as there was little he thought he could do.

Towards the end of July 2015, Suresh received a WhatsApp message from Bhandari which said that he had lost trust in Bhardwaj and GainBitcoin, and that he is moving out of the investment. Suresh continued pinging GainBitcoin support through 2016 but to no avail. (See Suresh’s Experience with GainBitcoin timeline at the end of this story.)

Finally, in April 2017, Suresh decided to put up a Change.org petition against this incident. Once the petition was up, he informed Bhardwaj on WhatApp about the petition. The two had a conversation on WhatsApp, that at least in one instance got heated and abusive. Bhardwaj was clear in his conclusion: it was Suresh’s lack of knowledge about Bitcoins that was at the root of the problem.

Now, here comes the twist: whenever a request is placed in the GainBitcoin system, like in many other systems, a ticket ID for the process is generated and its status is usually displayed. A request Suresh had placed in September 2015 was “pending” since then. Sometime after the Change.org petition went online, when one of the respondents asked for proof of the request being made, Suresh saw that the status of the transactions had changed to “closed” and that a transfer to the wallet had been completed.

Strangely, the address of the wallet was different from the wallet address Suresh had provided.

The anomalies did not end there. Being part of an open system, it is easy to find the details of transactions or details regarding Bitcoins. When Suresh checked the Bitcoin wallet to which the company claimed to have transferred the BTC, the transactions never seem to have taken place — the BTC was never transferred to it at all.

“The wallet address is different from what I had shared but interesting the transfer had not happened even to the wallet they had mentioned in the details, so basically nobody received the BTCs,” says Suresh.

Every time a BTC transaction happens they happen between two Bitcoin wallets who have unique addresses. So if you have the address of a Bitcoin wallet you can check for its balance and details of recent transactions online. But in Suresh’s case, the wallet address given on the dashboard did not reflect any transactions. As of publishing this story, there were still no transactions on the wallet.

Suresh’s chat with Bhardwaj was the last conversation he had with anyone related to GainBitcoin.

One obvious question is why Suresh didn’t file a police complaint or a first information report that is needed before any investigation on fraud can start? He doesn’t say as much but it looks like he got cold feet as the problem was related to Bitcoins, something that falls in grey territory as far as laws and regulations are concerned. He says he also felt the police won’t be able to help in the matter.

FactorDaily has verified every part of Suresh’s experience with GainBitcoin asking him for and verifying proof at different points in his interactions with the company and Bhardwaj. Still, it is possible that there will be angles and nuances that Bhardwaj and GainBitcoin may differ on — both in Suresh’s instance and the company’s operations. Like we said earlier, we will update this story if and when we hear from them.

Bhardwaj, as seen in videos and pictures online, is a wirily built, short man. His face is gaunt, he speaks with a drawl, and he looks like someone who has not slept well. But, there is high intensity lurking beneath the facade. Ask him an uncomfortable question and you will have him speaking animatedly.

According to his LinkedIn page, Bhardwaj attended a Kendriya Vidyalaya school, a central government run school chain of good standing (it is not clear which city he went to school), after which he attended a computer sciences graduate course at MGM’s College of Engineering at Nanded, Maharashtra, graduating in 2004.

Not so subtle in the aura built around him are prominent mentions of his past work before coming into cryptocurrencies. GainBitcoin marketing videos have him working 11 years as a software developer for companies such as Infosys and handling clients such as Boeing and Verizon. He was the founder of Highkart, India’s first online retailer that accepted Bitcoins; it shut down in 2016.

In the few videos — posted both by GainBitcoin and people who appear to be close to it — that FactorDaily reviewed, he comes across more as a marketer who tries to impress his audience with references to the blockchain technology behind cryptocurrencies. The analogies he uses are earthy and the focus is laser-like on just one thing: the returns he offers. In a video that looks like it was made on a mobile phone by a person among a group of 10 people in Bhardwaj’s office sometime after demonetization, he uses auto suggestion and reverse psychology techniques to connect with a sceptical and aggressive audience:

“The whole problem is that the way we think is too small.”

“The most illogical questions Indians ask is ‘What is the security in this?’ Shall I tell you something? Even banks don’t give you security.”

“I am not saying that blockchain technology is a great technology.”

“The government makes such fools of people in the name of currency and they continue to get fooled. After that, if somebody tries to something good, questions are asked.”

“In today’s date, technology and markets change at such a fast pace, your question becomes invalid.” He was responding to a question whether the company had in the past and will in future honour contracts with customers.

“I am not telling you that my company will run till the end of the world. But I am trying to run the company. If that happens, great. If not, no problem. Our intentions are not wrong and that’s the important part.”

Bhardwaj was speaking in Hindi and the above is a translation.

Bhardwaj owns and operates a pool of Bitcoin and cryptocurrency related operations ranging from mining pools to bitcoins payment processing service. The two most notable companies/products in his portfolio are GainBitcoin and GBMiners, both of which are subsidiaries of Amaze Mining & Research Ltd, a Hong-Kong based entity.

GBMiners, which stands for GainBitcoin Miners, is the mining pool and the backbone of the group operated by Bhardwaj. A product of Hong Kong-registered Amaze Mining & Blockchain Research Ltd, the company claims to be first Bitcoin mining pool from India and the biggest from outside China. According to Blockchain.info, as of writing this story the pool controls around 3.8% of the BTC hashing power. Hashing power is a way to describe the power of a cryptocurrency mining hardware or network.

The mining operations take place in China and there are multiple online videos of GainBitcoin investors visiting these mines in China. Most of these videos show an investor walking the viewer through an old warehouse like building with rows of equipment that look like mining hardware stacked next to each other. In some of the videos, you can also see giant fans being used to cool equipment.

Deepak Srivastava, a businessman with a strong activist streak, is sceptical about GBMiners. “They said that they do the mining in China but when somebody would ask for an address of a mining farm they said that they could not give it,” he says. In his two years of knowing GainBitcoin, he adds, he doesn’t know anyone who has visited these mines. New Delhi-based Srivastava knows a thing or two about these things: he was formerly National Manager – Fraud Control Unit at insurer ICICI Lombard.

The origin of GBMiners is somewhat of a mystery. There are reports it of being a company founded by Delhi-based startup Darwin Labs, founded by Nikunj Jain, Sahil Baghla and Ayush Varshney, that had raised an undisclosed amount of Series-A funding from Amit Bhardwaj.

But CEO Baghla later on posted a clarification on this report in which he said that Darwin Labs had been a software vendor for GBMiners’ mining operations but later decided to cut ties with the company and stopped associating with them. “Darwin Labs, its founders or employees are not associated with GBMiners anymore, which implies we are not even their software vendors anymore. We have absolutely no commercial/professional relationship with GBMiners or Amit Bhardwaj at all,” Baghla said in the post.

Baghla also mentioned in the post that the Darwin Labs team did not have much idea about the hardware aspects of mining and the source of funds for GBMiners’ mining operation. “It is our lack of understanding of the subject that led us to work for GBMiners as a software vendor without understanding their source of funds or their business model.”

The founding team at Darwin Labs had also launched an accelerator for startups working in the blockchain space, called Satoshi Labs, and had raised some funds from Bhardwaj, who also joined the accelerator as a mentor. After their disassociation with GBMiners, Darwin Labs returned the funds they had received from Bhardwaj for Satoshi Studios and also removed him from the list of mentors.

Explaining the company’s stance, Baghla wrote, “We had, at a point raised money from Amit Bhardwaj, among other investors, but thankfully, before we could issue shares, we realised that accepting this money is not in the best interest of Satoshi Studios, hence, we have returned all the money and absolutely severed all professional/economic relations between Satoshi Studios and Amit Bhardwaj.”

It doesn’t sound like an amicable separation but Bhardwaj has not talked about it anywhere in public for us to know his views on the matter.

Now comes his next venture GainBitcoin, through which investors are onboarded by selling them cloud mining and Bitcoin investment plans, which they are told is powering GBMiners’ mining operations. These investment plans are offered in the form of Bitcoin mining contracts which give out monthly payments in lieu of the investments made.

To onboard users GainBitcoin starts by hosting seminars where attendees are explained about bitcoins and how they can make money through investing in GainBitcoins. Srivastava, the former ICICI Lombard executive, was interested to know more about Bitcoins and as early as in the beginning of 2015 attended a few such seminars conducted by GainBitcoin.

He says the messaging was consistently focused on returns — that Bitcoin mining is very profitable and that someone investing in 1 BTC will get 1.8 BTC after 18 months. “They used to rope in people with vast networks and HNIs for promoting… Many people did not understand mining but when they heard that they will get 1.8 BTC in return, they agreed.” For perspective and context, Indian stock markets in their recent bull run returned about 38% in the 18 months between February 2016 and July 2017.

In a cover story for the Caravan magazine in March, reporter Aria Thaker peels the layers on Bhardwaj’s empire. Thaker interviewed Bhardwaj four times for the story during which she wrote “he repeatedly contradicted himself and was evasive about the relationship between GBMiners and GainBitcoin”. “He also admitted, with casual ease, that he had lied to his investors about crucial information regarding GainBitcoin’s investments (“They feel good, right? When they get high information,” he told me about his customers, after admitting to using inflated figures on GainBitcoin’s website.)”

Thaker also talked to Stuart Trusty, a bitcoin miner and an expert. “Trusty told me that GainBitcoin’s promised returns were “mathematically impossible”, she wrote. The operation “would have to be a Ponzi”. At its simplest, a ponzi scheme is one which you borrow from Peter to pay Paul. Trusty’s conclusion was that Bhardwaj’s operation was built on getting new investors in into GainBitcoins to repay the old ones.

The MLM structure deployed to penetrate the market and doubts over whether it is legal in India in the strictest sense of the word has led to, not surprisingly, GainBitcoin headquartered abroad. But what is odd is the overseas registered companies associated with GainBitcoin. The GainBitcoin contact us page lists a Singapore address — VariableTech Pvt Ltd, The Franklin, 3 Science Park Drive, Singapore 118223 — which according to registration documents is a company that Bhardwaj is a part of.

If you further venture into the links on the bottom of the site, the link ‘Team and Company Information’ leads to a PDF about Amaze Mining & Research Ltd group of companies. Even though there is no mention of GainBitcoin in the PDF as such, all the other companies in the group are present, including GBMiners. According to some online databases, Amaze Mining & Research is registered in Hong Kong. A company called Amaze Mining & Blockchain Research Ltd shows up on the Chinese company registration site; it was registered in Hong Kong on March 18, 2016. In April this year, Bhardwaj posted on Linkedin that Amaze Mining & Research has a 150-member team and operates out of offices based in Dubai, Hong Kong and China.

Cross-country corporate holdings are common in businesses today but linkages that are not explained clearly, especially when a business — even if unlisted — is offering unheard of returns has red flags going off in several minds. Srivastava says he was witness to a sharp rise in interest in Bitcoins in general and GainBitcoin in particular during the demonetization period. He has written to investigating agencies Enforcement Directorate and Central Bureau of Investigation about Bhardwaj and his companies.

Bhardwaj, who says he works from Dubai and Singapore, himself acknowledges risk when asked by a prospective investor in the GainBitcoin office on what he (the investor) would do if GainBitcoin one day suddenly went belly up or disappeared like other MLM companies such as SpeakEasy, Click, and QNet. “In your India, there is a small problem. Every police constable will come and stand in front of my office if I open one here,” Bhardwaj says. “There are no laws in India then how will I operate lawfully in India? Give me immunity from the police and I will open the biggest office here,” he is seen telling the group sitting in what appears to be his Delhi office.

Other than GainBitcoin and GBMiners, Bhardwaj’s Amaze Bitcoin and Blockchain Research owns and operates Bitex, a Bitcoin exchange, Paybitz, a bitcoin payment processor, and Coinbank, a Bitcoin wallet.

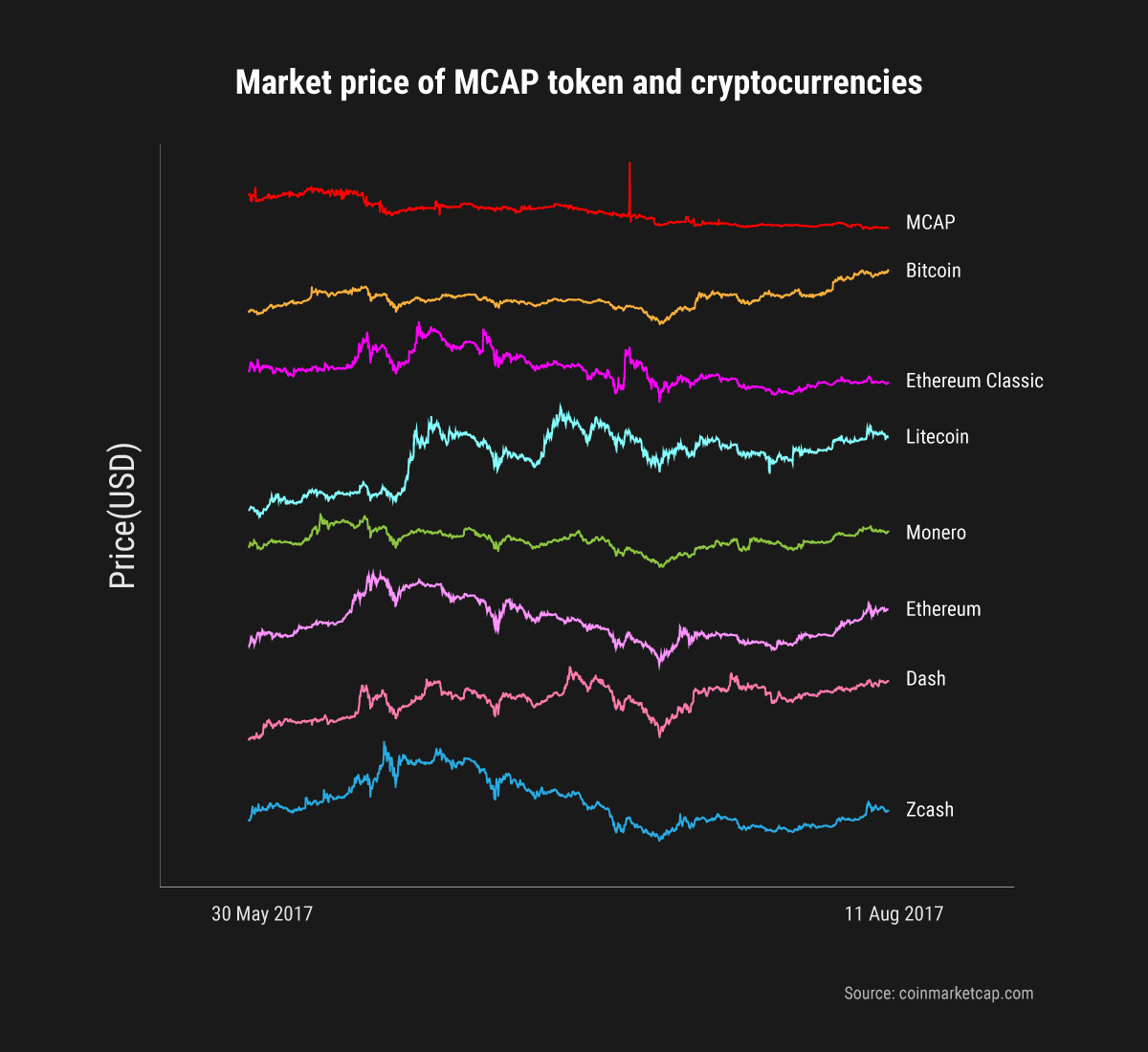

MCAP, which stands for Mining Capital, is Bhardwaj’s latest cryptocurrency-based product launched late April this year. According to its parent website, Bitcoin Growth Fund, MCAP token is a mining fund and initial coin offering (ICO) being sold at a value of $ 5.0781.

The site also mentioned that MCAP Labs, the operation behind the MCAP token, will use the investment made through MCAP tokens to also mine cryptocurrencies like Bitcoin, Litecoin, Dash Coin, Ethereum, Lite Coin, Ethereum Classic, Z cash and Monero.

Even though there is no mention of Bhardwaj or the team behind Bitcoin Growth Fund on its site, Bhardwaj’s personal site says he is the founder of MCAP Labs.

According to a June 2017 news report in The Economic Times, Bitcoin Growth Fund had raised $14.5 million (approx Rs 95 crore) through an MCAP token sale as part of its ICO. In an ICO, similar to an initial share sale or an initial public offering, companies or projects sell crypto tokens in exchange for Bitcoins or other crypto currencies.

Srivastava recalls an announcement in the network around April this year when Bhardwaj said that he would start mining other cryptocurrencies also, alongside Bitcoins, and make payouts to GainBitcoin investors in MCAP tokens. “He started marketing it as a tool for mining other crypto currencies as well and said that future payouts will be given as equivalent MCAP tokens instead of Bitcoins. And being a homegrown token the value is determined by him only,” says Srivastava.

According to Srivastava, the team behind MCAP promoted it through mainstream media and other promoted endorsements. “The token was being sold at a value of around $5 and the company said that it will go over $100,” he says. At the time of writing this story, MCAP token was trading at $1.79 although the Bitcoin Growth Fund website lists the buy price of the token at $5. Bhardwaj’s book, Crypto Currency for Beginners, priced at Rs 1,499 comes with cryptocurrencies (like MCAP) worth Rs 1,200.

Complaints and negative comments about GainBitcoin and Bhardwaj can be seen all across social media from supposed investors who claim that they have been cheated or not receiving refunds and payouts.

But for every negative comment or complaint against Bhardwaj or GainBitcoin on social media, you will see a barrage of comments in support of the company. Those posting the messages insist that Bhardwaj is genuine and that they have made money through GainBitcoin and are getting regular payouts.

It is not very difficult to get paid positive comments or ratings on the internet today but even naysayers like Suresh and Srivastava agree many of these comments are genuine. “Even on our petition, there are a lot of commenters saying that they have made money, which is true. I am not saying that every investor is not getting their returns. There are a lot of them who are getting and a lot who are not,” says Suresh. The comments on a July story on Bhardwaj that we did at FactorDaily tells you the extent of the following that GainBitcoin has; it remains FactorDaily’s most commented on story.

The scale of the problem of missed payouts in the Bitcoin ecosystem is not clear. In the past, MLM schemes implode when investments from new, incoming investors fail to cover the cost of payouts from earlier investors.

We have tried several times to find the answer to the question whether cryptocurrency MLM investment schemes are legal in India. We asked regulators the question again this time specifically about such schemes built around cryptocurrencies. Almost every regulatory body, government department or ministry has a cautious approach and have worded their take in such a way that it is difficult to interpret the exact legality.

We called an RBI spokesperson and were directed to this circular on virtual currencies. (Read VCs as virtual currencies here and not venture capitalists.) “It is reported that VCs, such as Bitcoins, are being traded on exchange platforms set up in various jurisdictions whose legal status is also unclear. Hence, the traders of VCs on such platforms are exposed to legal as well as financial risks,” it reads.

The only conclusive point in the above statement is that there is a risk in dealing cryptocurrencies.

The central bank goes a little further warning users trading or using Bitcoins. “There have been several media reports of the usage of VCs, including Bitcoins, for illicit and illegal activities in several jurisdictions. The absence of information of counterparties in such peer-to-peer anonymous/ pseudonymous systems could subject the users to unintentional breaches of anti-money laundering and combating the financing of terrorism (AML/CFT) laws,” reads the circular.

In a March 2017 speech, RBI deputy governor R. Gandhi signalled the central bank’s discomfort with cryptocurrencies. “Value (of virtual currencies) seems to be a matter of speculation. Legal status is definitely not there. While this is a purported objective of a VC, it puts a natural limit for its progression… And finally, the usage of VCs for illicit and illegal activities has been reported as uncomfortably large,” he said in his speech.

Earlier, in a January 2015 statement, the RBI had clearly stated that accepting money under MLM or pyramid structures or so-called money circulation schemes is an offence under the Prize Chit and Money Circulation (Banning) Act 1978. “The Reserve Bank has advised that members of public should not to be tempted by promises of high returns offered by entities running Multi-level Marketing/Chain Marketing/Pyramid Structure Schemes. The Reserve Bank has reiterated that falling prey to such offers can result in direct financial losses and they, in their own interest, should refrain from responding to such offers in any manner,” it read.

But the key point here is whether cryptocurrency is money or not. Currently, Indian laws and regulations are not clear about it but the government may be moving towards a decision. Earlier this week, we at FactorDaily reported that an interdisciplinary committee set up by the government had recommended that cryptocurrencies should not be allowed in the country.

Just in: Expert committee set up by govt has recommended that Cryptocurrencies should not be allowed in India, sources tell @factordaily.

— FactorDaily (@factordaily) August 9, 2017

This may look like a case of throwing the baby out with the bathwater but it is a beginning nevertheless. As a FactorDaily follower on Twitter pointed out, the government’s views on internet technologies — think WhatsApp, for instance — has always been tentative and fast changing.

The recommendation is before NITI Aayog, the central government’s top planning body. The committee, set up in April this year, had members from the finance ministry, home ministry, ministry of electronics and information technology, RBI, NITI Aayog, and State Bank of India.

What about SEBI? What does it think of GainBitcoin? Under India’s Securities Laws (Amendment) Act 2014, a Collective investment scheme is one which pools funds from investors and involves a corpus amount of Rs 100 crore or more. Such schemes are mandatorily required to register with SEBI. But it is not very clear if GainBitcoin’s operations will come under this purview though the value of the Bitcoins in the network — Bhardwaj in interviews has said that GainBitcoin has over 100,000 investors — seems to be in far excess of the Rs 100 crore threshold.

It is not known whether the company has registered itself with SEBI.

At least one expert familiar with Indian securities law is astonished that SEBI has not taken action yet. “It (Bitcoins or MCAP) is an instrument and this is a collective investment scheme. Tomorrow, if I do a scheme with shares, will it be allowed,” asks Mohandas Pai, former CFO of Infosys and a financial regulation expert. Pai has recently been appointed to head a SEBI committee to make recommendations on financial and regulatory technologies.

In a series of video interviews (it is not clear but these interviews seem to be from cryptocurrency blog BITREV Mining), Bhardwaj states that GainBitcoin has applied for registration as an MLM operation with the Department of Consumer Affairs, that the application is under review, and that he is awaiting the department’s approval.

Direct selling and MLM schemes come under the purview of The Ministry of Consumer Affairs, Food and Public Distribution and are governed by the guidelines put out by the ministry.

The interviewer then goes on to ask whether he will continue to operate the company in India if the MLM approval does not come through. Bhardwaj says that the only difference will be that GainBitcoin will not have a registered office in India.

The videos have a backstory of their own. They were on YouTube initially but were taken down without any stated reason. Bitcoin blog Coinjournal, which had done stories on Bhardwaj and GainBitcoin in the past, uploaded the videos on its YouTube channel, only to receive a take down notice. Coinjournal decided to directly upload the videos on its website. You can see the series of interviews here.

Bhardwaj is combative when questioned about GainBitcoin reserves and if he can make good payouts promised to investors. In the video that has the group of prospective investors in his office, he challenges them to get a third-party valuation done of his businesses. In the conversation he says it will not be less than Rs 1,200 crore.

Surprisingly, none among the otherwise aggressive group asks him for the basis of that valuation. Which is the story of Bhardwaj’s GainBitcoin empire: greedy and gullible investors, an underlying technology that few understand, and regulators sitting on their hands as crafty businessmen merrily run circles around them.

[whatsapp_form]

The story was updated at 4.30 pm on August 11, 2017 to add Abhishek Bhandari’s response.