Chinese content giants that had flocked to India and were beginning to dominate the crowding market here are finding that there may not be enough space for them all.

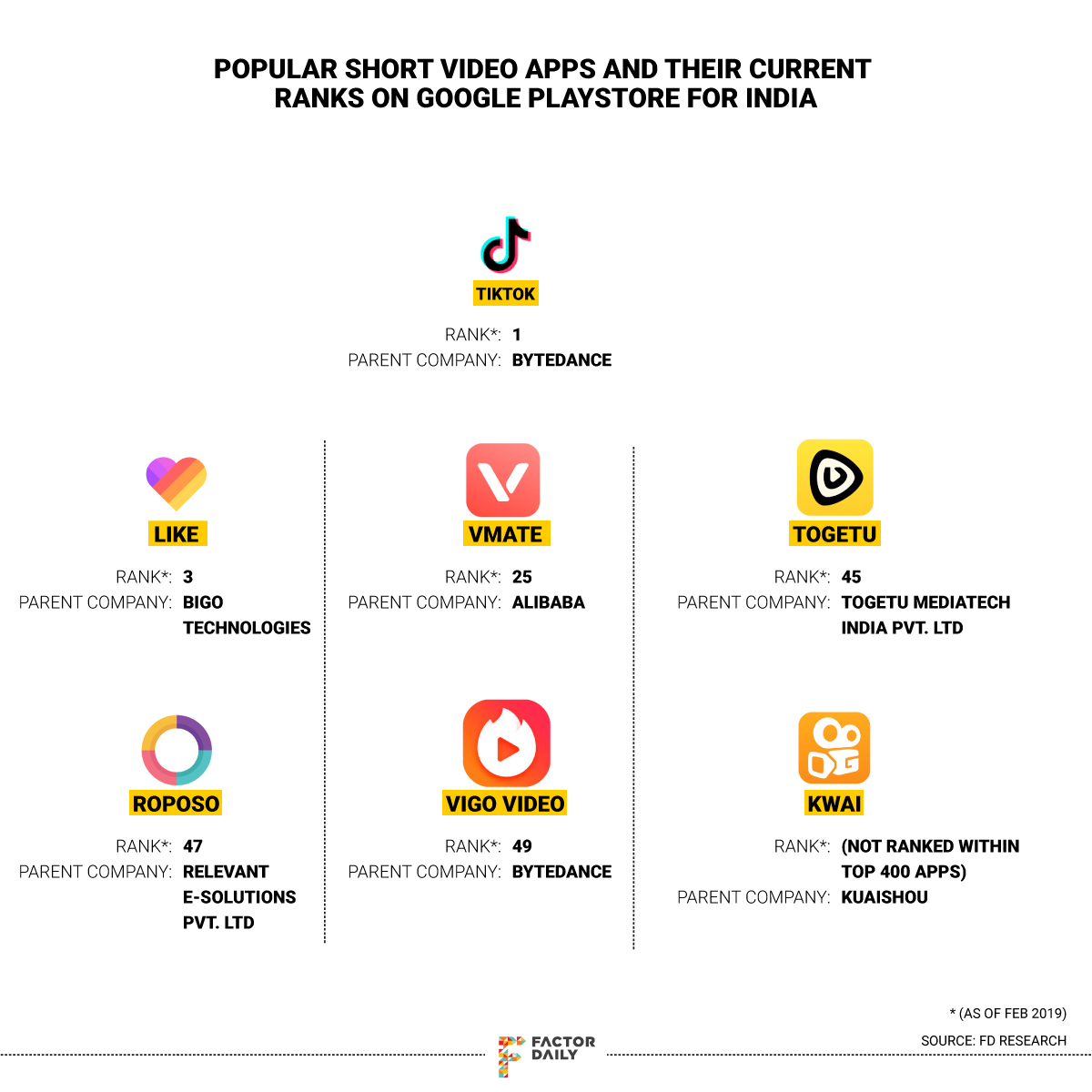

Kwai, a short video app by Tencent-backed Kuaishou, and Alibaba-backed VMate are rethinking their India strategy as Chinese giant ByteDance’s popular platform TikTok races ahead to capture a large share of the domestic market.

Kwai, which is notorious for its sleazy content and has a borderline child porn content problem in India, has stopped marketing operations in the country, said three industry people aware of the developments. VMate has slashed payments for its content creators who were crucial to the platform becoming popular in India.

“Kwai has stopped spending on customer acquisitions and creators in India because the top executives think the return of investment in this market and model is very low,” said an executive with a leading internet company in Beijing, speaking on condition of anonymity as did the other two.

“VMate, which is focused on lower-tier content creators, hasn’t been able to find a way to convert the spends on this market into revenue,” said another person familiar with the developments at the company. “They have reduced the compensation for their creators, who in turn have many other platforms to flock to that are ready to pay them.”

India’s short-video market is about a year old but gained traction rapidly because of its ease of use and viral content. Anyone with a smartphone and an internet connection can create and broadcast short videos on apps and get paid for them based on the popularity or virality of the videos.

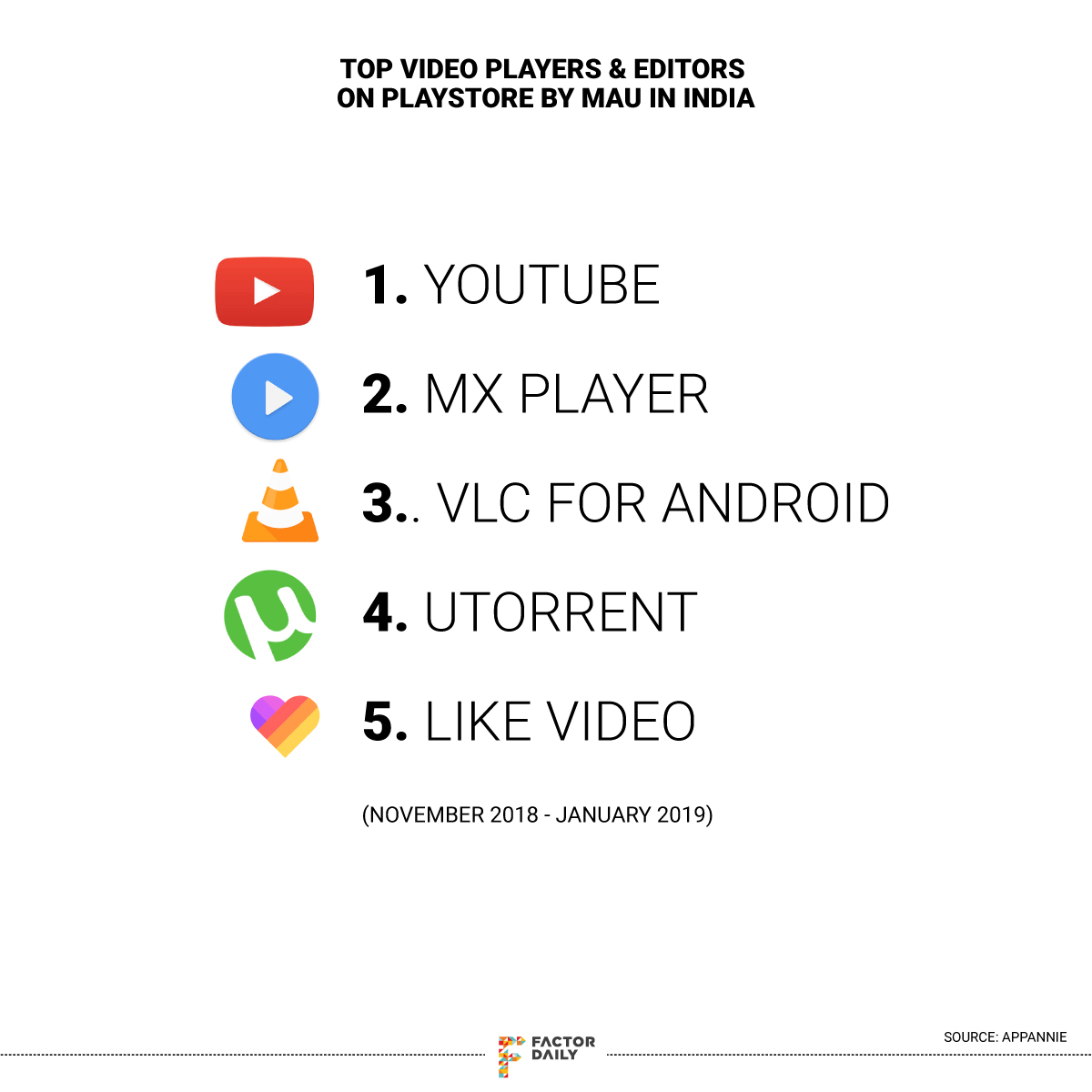

TikTok, with 52 million monthly active users in India, leads the pack of short-video apps. The platform, popular among urban as well as rural users in the country, has consistently ranked among the top five apps on Google Play store in India for more than six months now. It has gained enough traction for domestic brands such as online fashion retailer Myntra and matrimony platform Shaadi.com to advertise on the platform.

VMate and Kwai, although they rank among the top platforms in the country on Google PlayStore, haven’t been able to sustain their pools of creators to retain users.

“If you are building a community in the same space as TikTok, you need to spend a lot of money because content creators and consumers in the space have many options,” says Pratik Poddar, vice-president at Nexus Venture Partners, a VC firm. “For Kwai or VMate, the willingness or intent to invest very heavily in the India market in terms of money and effort does not seem right at a time when TikTok has managed to get a significant hold over the market.”

This is evident in the slashed spending on content creators by VMate and Kwai, whose owner Kuaishou is valued at $18 billion. “Until 6-7 months ago, Kwai was paying around Rs 12,000 per month to 200 top creators,” says Kimmy Nagpal, a fashion designer in Delhi who was a paid creator on several platforms including Kwai and VMate. “Now, they barely have 5-10 paid creators. After they stopped paying, creators moved to other platforms.” She says VMate, too, has shrunk its number of paid creators as well as reduced payments to them.

FactorDaily has reached out to VMate and Kwai for comments on the developments but did not receive a response from the companies.

Kwai, meanwhile, has introduced a video-making app called MV Master. “It is easier to monetise (and get ads) for a tool rather than monetising a platform,” said the first unnamed person quoted earlier.

Chinese app makers have a long history with recognising the market need and making appropriate tools for a market. A case in point is SHAREit, a platform that allows peer-to-peer media sharing and has become a favourite in India and other emerging markets.

Chinese content giants are in the midst of a battle in their home turf as well. The Chinese market is rife with apps such as ByteDance’s Douyin (TikTok in English) and Kuaishou (Kwai in English), apart from those of Baidu, Alibaba and Tencent (the BAT trio), which have Lu Ke, Nani and Weishi, respectively.

Although it is not core business for the BAT trio, the short video space in China is getting too big to be ignored. Over one-third of the country’s 1.4 billion people are active on these apps every month. The popularity of TikTok has giants like Tencent, which owns messaging app WeChat, worried with news reports suggesting that the use of instant messaging services has waned in China amid a growing obsession with short videos.

Rivals Douyin (TikTok) and Kuaishou (Kwai) had started out with targeting different sets of users. Kwai was more focused on the massy lower-tier segment in China while TikTok focused on tier 1 and 2 users. But as the battle intensifies, both the platforms are chasing more users including through expansion to markets such as India, where the population and internet ubiquity makes for an attractive bargain.

Earlier this year, FactorDaily reported how Chinese apps have taken over the Indian app ecosystem. The number of top Chinese apps in Google Play store in India almost tripled from 18 in December 2017 to 44 12 months later. Most of these apps fell in the categories of either utility or entertainment.

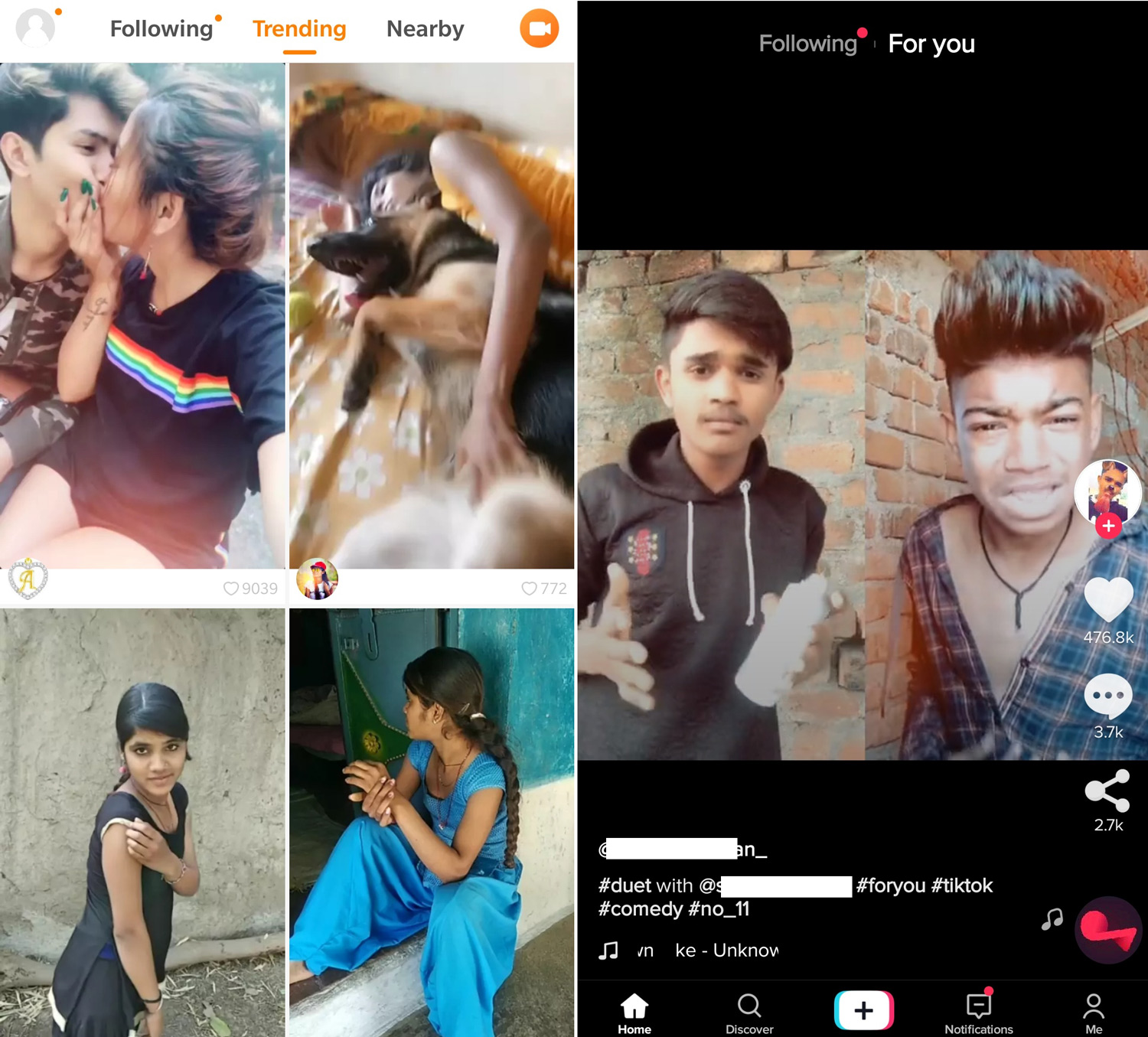

The names and even the content on many of these apps are similar: there’s Bigo Live, LiveMe and UpLive for live streaming, where girls from the hinterlands login on their phone screens and talk to men manning shops and grocery stores and ask them about their day. There are short video apps including TikTok, Kwai, VMate, ToGetU, LIKE, WeLike and a bunch of others that have an endless stream of short videos of women dancing in the fields or men tripping over from cycles. The next big thing in social media aspirants are platforms like Helo and NewsDog, apps such as LivU and ZakZak promise to help users meet “hot girls,” while apps like Vidmate and Videobuddy provide pirated versions of the latest movies and serials. The Chinese apps are running a wholesome entertainment factory for mobile internet users in India.

“The Chinese have cracked the online distribution model in India by spending disproportionate money on acquiring paid users but are struggling with the content model and engagement,” says Prateek Lal, founder of Mumbai-based digital content company Talent Dekho.

Lal says the Chinese apps are banking on existing creators to keep generating new content for their platforms. But their lack of understanding of the Indian culture and market has prevented them from finding and grooming new creators. This, according to Lal, is resulting in a mad scramble across the Chinese companies in India for the same set of creators and a similar user market.

Amid this, a bunch of former employees of VMate in India have started a new short video platform targeted at the tier 1 audience, called ToGetU. “In a way, ToGetU is filling the gaps of VMate. It is focused on tier 1 Indian users, a relatively easier-to-monetize market,” said the first person quoted in the story. ToGetU has 10 million downloads and has ranked among the top 10 apps in the video player category in India for the last two months, according to data from SensorTower.

ToGetU’s initial success on Google Play store is not an unusual feat in the Indian app ecosystem anymore. There are new users jumping on the cheap internet+smartphone bandwagon every day looking for entertainment. The cost of acquisition of such users in the India market is as low as Rs 3 per user, according to Forrest Chen, founder of NewsDog, one of the earliest Chinese entrants in the regional entertainment platform market in India.

What’s challenging is to retain their interest after the novelty of such content dies. Even more challenging is to find ways to monetise these users, who generally come from a very low-income belt.

“For large-scale advertisers (like Flipkart), we try and stay away from platforms that have a large install base but little user activity and there are many such platforms out there,” says Vijay Sharma, Flipkart’s head of digital media and brand marketing at Flipkart.

TikTok, though not as large as Instagram or Facebook, has a monthly active to daily active ratio of nearly 50%, says Sharma, whereas for most apps this ratio is 10%. “Barring brand safety (related to questionable content and copyright issues at times) there is no other deterrent for us to advertise with them. That said, we are working with their parent Bytedance to have better means of advertising on TikTok.”