Last September when OYO Hotels raised $800 million from Japanese conglomerate SoftBank and others, the headlines were about the $5 billion valuation of the company founded by boy wonder Ritesh Agarwal. OYO has been through the whole cycle of being hailed as the poster boy of Indian startups to being torn apart by media – and is back in the reckoning now.

The gumption of Agarwal – he started OYO when he was 17 years old – is well and alive eight years after he started. Today 25, he has upped the game and set out to take on a new share of challenges in a market far more complex and fragmented than India: the China market. “China’s hospitality landscape is as fragmented as that in India, with over 35 million unbranded rooms in the country,” says Agarwal.

With just a year of opening its presence in China, OYO has entered 280 cities, operating more than 5,000 hotels with 260,000 rooms, according to a statement sent by the company.

That’s no easy feat.

For many years now, the Middle Kingdom has remained a challenging and unchartered territory for global companies looking to launch in China.

Tech giants like Facebook, Google and Twitter, which have successfully expanded into different parts of the world, haven’t been able to get past China’s internet firewall. China, by far the largest e-commerce market in the world, has been tough to crack for global e-commerce giant Amazon that has been able to acquire less than 2% of the market there in the last four years. Uber was locked in an intense battle with Didi Chuxing in China before yielding in 2016 in a sellout to Didi.

Given these circumstances, it’s commendable for any foreign company to sustain in the China market. It is for this reason that Amit Haralalka, GM of Capillary Technologies in China, has a busy inbox on LinkedIn.

“Old classmates from IIT, colleagues I’ve worked with in the past, and friends of friends pop up in my inbox every other week,” says Haralalka, who spearheaded Bengaluru-based Capillary Technologies’ China division in 2016. “They all want to know about China.”

Haralalka represents a rare bunch of Indian companies that have ventured into the China market – and have early lessons and some success to show for.

While there has been an onslaught of Chinese companies – think Xiaomi, Huawei, ByteDance and Kwai – in the Indian market, the number of Indian technology companies aspiring to launch in China has been very low.

To be sure, software services companies Infosys, Tata Consultancy Services, Wipro, iGATE, Zensar, and others have been operating in China for over a decade now. Larger conglomerates such as the Tata group, Reliance Industries, AV Birla group, and lenders including Axis Bank, Punjab National Bank, and Canara Bank have all been operating in China, too.

But their presence in China has hardly moved the needle for them. China-India trade will likely top $100 billion this financial year – it was nearly $90 billion in 2017-18 – but few Indians, if any, have learnt what it takes to break into the world’s second-largest economy.

On a recent trip to China, I decided to try and spot Indian companies that have made a dent in the China market and zeroed in on adtech platform InMobi; Capillary Technologies, an omnichannel retail SaaS solution; and hotel chain OYO Hotels.

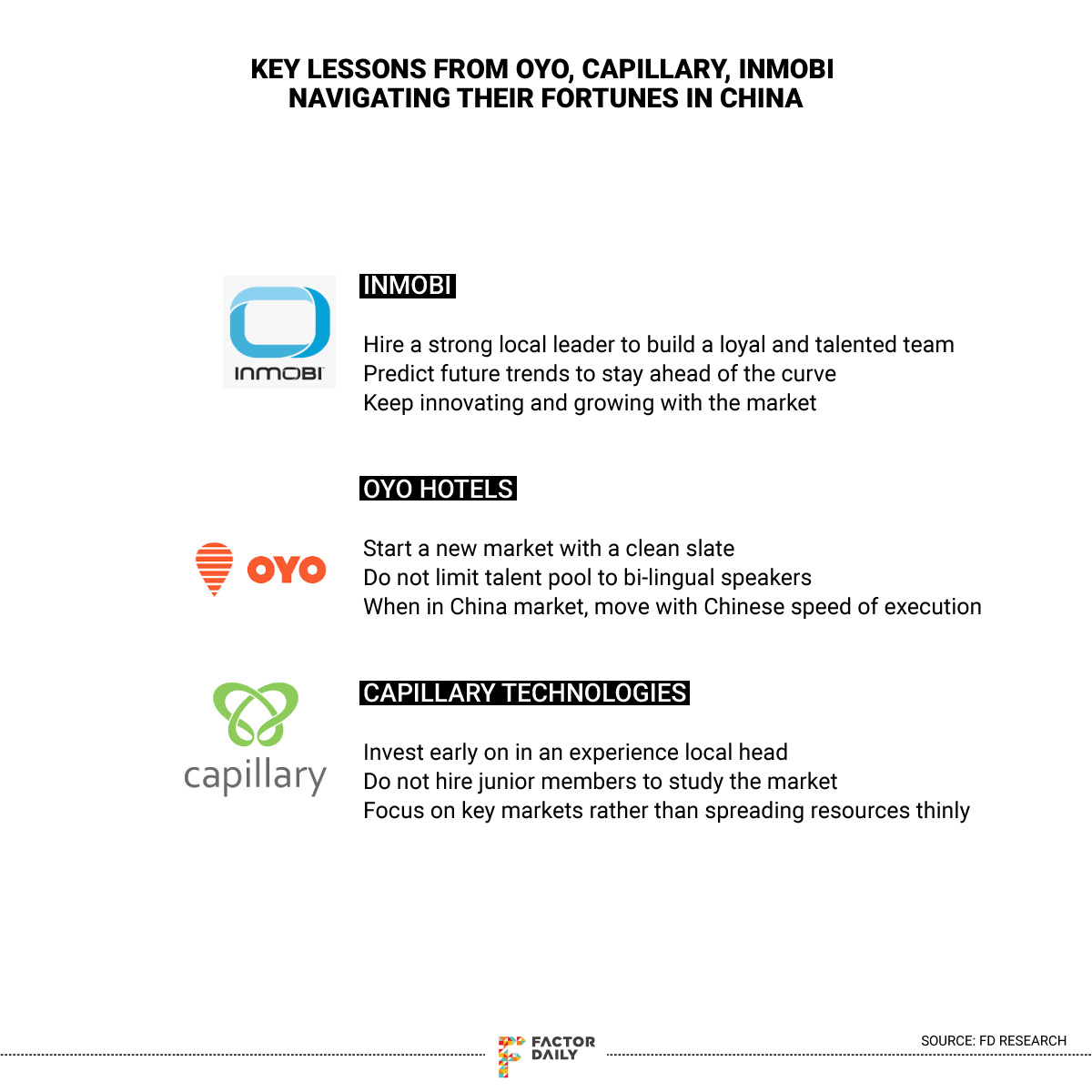

The journey of these companies holds interesting lessons for Indian companies aspiring to launch in the complex Chinese market. They are far from claiming success there but hold lessons for others waiting in the wings.

The journey of these companies holds interesting lessons for Indian companies aspiring to launch in the complex Chinese market. They are far from claiming success there but hold lessons for others waiting in the wings.

Importantly, she has remained with InMobi for seven years, thereby ensuring that learning gets accumulated within the firm, he adds.

Yang reiterates the importance of retaining talent. “It’s a small team here. But most people have stayed with us from the beginning,” she says.

The company has had its set of learnings, though. The initial plan of the company was to go big on acquiring large brands as customers, says Ravi Shankar Bose, founder of Fugu Mobile, a digital marketing company in Shanghai.

Bose, who moved to China in 2000 and subsequently founded his own venture in 2004, says that the mobile advertising market in China is highly competitive and largely dominated by the internet giants in China, leaving little scope for other players. But what a company like InMobi has managed to do is tap into its existing China customers and help them advertise in markets beyond China, including India and the US. That’s a move that has worked well for them, says Bose.

In early 2000, when his employer Contests2win, an internet gaming company from India, decided to venture in China, Bose recalls, it was one of the first companies from India attempting to capture the China market. The company set up its China arm, called Mobile2win, which was later acquired by Disney. Bose stayed back and decided to apply his learnings to Fugu Mobile. His is a rare example of an Indian founder setting shop in China first before expanding to other markets.

“The China market is much better and more open to foreign companies now,” says Bose, adding that the existing companies, including Capillary Technologies, OYO Hotels and InMobi have done a good job of localising their offerings to the extent that Chinese players have no idea that the companies behind them are Indian.

What’s different between the software services companies that came to China earlier and new product companies such as Capillary is that the new crop didn’t come with a we-are-a-star mindset, says Bose. “They were ready to start from scratch and customise their products to suit the market needs,” he adds.

Last week, OYO’s Agarwal announced the appointment of Sam Shih as its chief operating officer for its China market. OYO’s China unit has a 5,500-member team led by Jia Zhou, who serves as its chief technology officer, and Wilson Li, its chief financial officer.

“While customers in India expect full-blown service even at economy hotels, Chinese customers’ expectations tilt more towards having the better infrastructure at economy hotels,” says Agarwal. He counts roughly 600 supply chain vendors across China providing infrastructure including wiring, piping, ceiling, among other services and support.

Within a year of starting operations, China had overtaken the India market in size for OYO Hotels. “It’s almost surprising the speed at which OYO Hotels, a completely consumer-facing business, has established in China,” says Bose, adding that localisation has been a key for the company.

The company that raised $800 million in investment led by SoftBank had announced its intent to invest $600 million from its fund-raise for expansion in China.

“We didn’t approach the market like an Indian startup setting shop in China, but like a Chinese player building and localising the OYO Hotels business model to make it work in the Chinese market,” says Agarwal.

For instance, most foreign companies look at recruiting bilingual management teams in a different country. “We didn’t make that a criterion because a local company wouldn’t have that constraint and if we had that constraint, we would narrow our talent pool,” says Agarwal.

The localisation efforts helped the company customise their offering from the point of view of a traveller in the country and fill the gaps that travellers faced with existing hotel chains.

Currently, OYO Hotels gets close to 80% of its business from organic channels such as call centre and walk-ins and over 15% through third-party distributors like online travel agents, offline travel agents and others, Agarwal says.

In the case of InMobi that has to compete with giants like Alibaba and Baidu for the mobile advertising market, Yang says the only way to survive in the market is to keep innovating and moving faster than the market.

“We need to make sure our product launches are at least 3 or 4 quarters ahead of them. Otherwise, it’s hard to compete with the local incumbents,” says Yang. InMobi counts the US, China and India among its top markets.

Last year, the company built a data centre in Beijing.

Yang says that in the last two years the company has built local products, like artificial intelligence-powered video ads that were first launched in China and later in the US.

InMobi’s strategy in China has been focused around finding sweet spots ahead of the curve in new market trends, says Prashantham.

The company started by tapping the wave of Chinese online firms, including Tencent, that were seeking customers in international markets. In the next wave, InMobi worked with these firms as they started to target the home market (China) which had begun to emerge and then turned its attention to the rise of Apple in the Chinese market, Prashantham adds.

In the case of Capillary, which provides a cloud-based omnichannel solution for brands, localising the product was a whole new ballgame.

There are hundreds of data points available about customers in China that can help build a much better and richer omnichannel experience, says Haralalka, the Capillary China GM.

For instance, large players like Tmall, a platform that connects brands with consumers; JD.com (Jingdong), an e-commerce platform; or Tencent, that owns humongous data coming from both brands and consumer side, have mature platforms that share with brands much richer information.

“In India, marketplaces, like, for example, Flipkart, don’t share that kind of information,” says Saigal, the Capillary revenue head.

Capillary’s solutions are integrated with all these top platforms now. But Saigal says it’s quite a ride – to build products on top of these various platforms, understand transactions coming from these platforms, using that to engage on WeChat as a major communication channel and integrating with WeChat… all of which requires a thorough understanding of how the ecosystem works.

In July 2016, Capillary released its first product specifically for the Chinese market, a social CRM developed based on WeChat, which was earlier than most competitors.

“For people like us coming from outside to get hold of that documentation, figure out how to do it, hire the right skill set and execute our idea, it has been a journey,” says Saigal.

For instance, Tmall’s loyalty programs for brands. As a platform, it won’t just connect consumers to brands it will also help brands acquire customers. “Things change here like it’s no one’s business,” says Saigal. “You have to constantly be on top of things.”

Capillary now has a team that works closely with large platforms like JD.com to constantly innovate its product offerings.

“Prioritising China is not a decision to be made lightly; it may even entail letting go of other markets,” says Prashantham.

For instance, after it entered China in 2015, Capillary – that had earlier expanded in other markets including the US, the UK and the Middle East – decided to switch its focus back to Asia. As a small company, Capillary knew it should focus, rather than spread its resources thinly, and Asia seemed to be a good market to focus on, says Prashantham.

Being an outsider in China might also have some advantages.

Capillary, a venture-funded company, was financially independent of China’s Baidu, Alibaba, or Tencent (BAT), while many local competitors such as the Alibaba-invested Chinese CRM provider Shuyun were not.

Shuyun had more in-depth capabilities on Tmall (part of the Alibaba ecosystem) but limited capabilities on Tencent’s WeChat, which could limit its capability to provide comprehensive services for customers.