In January, when Doug McMillon, chief executive of Walmart Inc., the world’s largest retailer, came to India with Marc Lore, CEO of Walmart e-commerce, and Judith McKenna, CEO of Walmart International – they spent time at Flipkart’s office in Bengaluru and visited its warehouses.

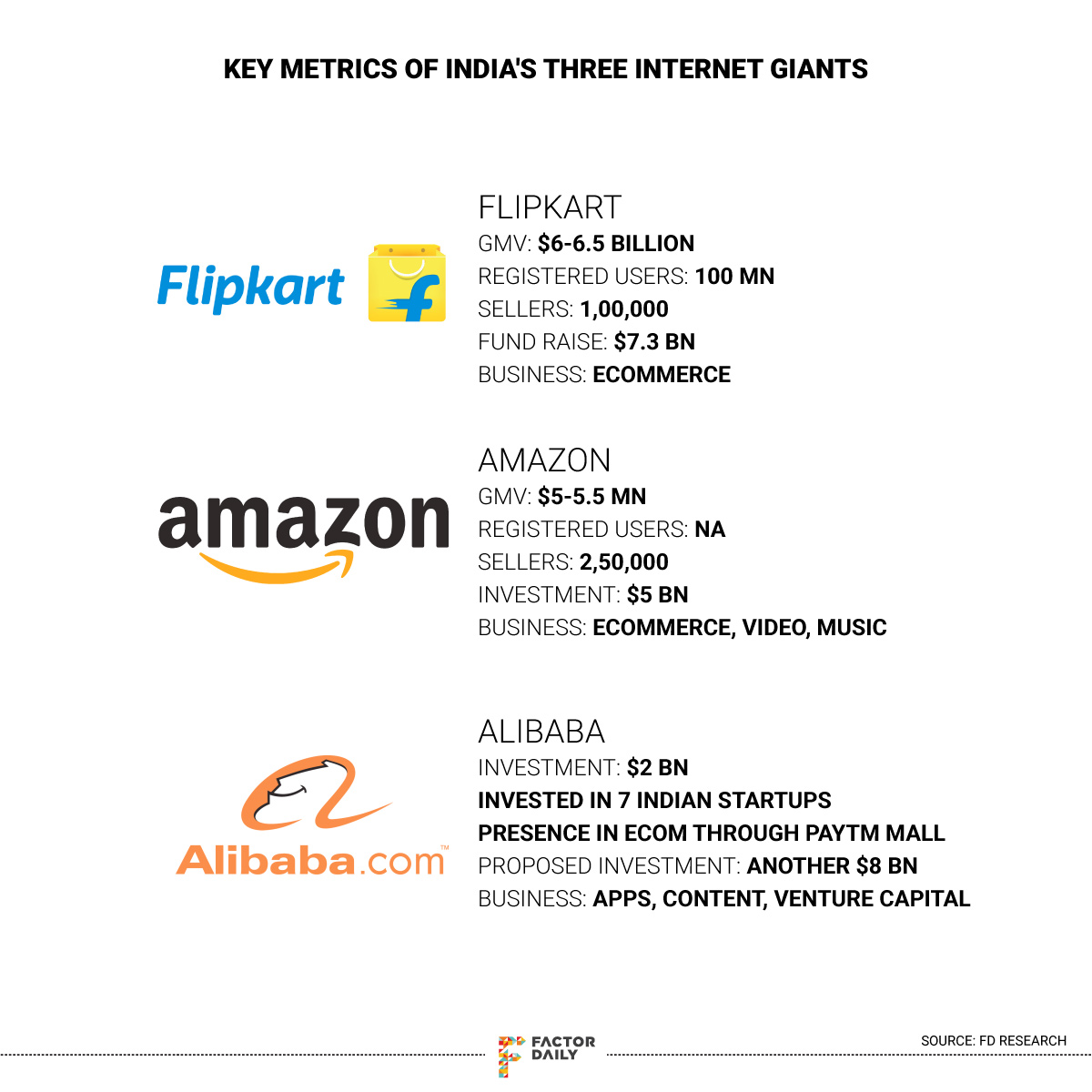

“Walmart’s meetings with Flipkart was to understand how India’s largest ecommerce company works and how can it be a strategic fit for Walmart,” said a source who is involved in the Walmart-Flipkart deal. “Walmart couldn’t afford to lose in India for long. Amazon is already big, Alibaba will make a big bang entry anytime into India.”

The meetings have lead to the biggest deal in Indian ecommerce, where Walmart will commit to pay up to $12 billion to buy controlling stake in Flipkart, which will be valued at anything between $16 billion and $20 billion. It’s a big deal for Walmart, too. “It’s the biggest deal for Walmart so far… close to what Amazon paid for Whole Foods,” said a second source, who works with one of the two companies in merger talks. Amazon paid $13.7 billion for Whole Foods.

Except that Amazon’s buying of Whole Foods was to get a food hold into brick-and-mortar business in the US – something it had been dabbling for a few years with experiments like Amazon Fresh and Amazon Go but without much luck.

“For Walmart, it is the opposite,” said the second source. “Walmart is very strong in physical retail, but has failed miserably in online commerce… an area where Amazon is miles ahead.” A source FactorDaily spoke with said that Walmart’s ecommerce sales is just $15 billion (out of which $11.5 billion happens in the US) — that’s just 3% of its global revenue of $500.34 billion.

Flipkart can change things for Walmart – from adding almost $3 billion in revenue (all online), opening up a large base of new customers, and help it become a meaningful competitor to Amazon, at least in India. Flipkart has 39% market share in ecommerce in India, followed by Amazon with 30%. To be sure, Flipkart has massive losses: Rs 8,771 crore in 2016-17 on revenues of Rs 19,854 crore but that is shrugged off as the cost of customer acquisition and technology spending in a new business.

It was perhaps not related but shares of Walmart shot up 10% in January. However, a potential Walmart-Flipkart deal brings cheer to the acquirer’s flagging online sales which has seen growth halve to 24% in the last quarter of its fiscal year (February to January) from the first quarter.

But, Walmart’s stepping into India’s ecommerce battle comes mostly from its learning in China and a little bit in Japan. And before zeroing in on Flipkart, Walmart evaluated smaller rivals like Snapdeal and ShopClues, last year.

But, Walmart’s stepping into India’s ecommerce battle comes mostly from its learning in China and a little bit in Japan. And before zeroing in on Flipkart, Walmart evaluated smaller rivals like Snapdeal and ShopClues, last year.

Flipkart is not just an investment for Walmart in India – it gives Walmart a large potential to make up for the lost time in India, said a three source with knowledge of the deal dynamics.

“Flipkart opens new opportunities for Walmart… It has a loyal customer base, has a great understanding of the market and has cash,” said a partner at a management consulting firm, who requested anonymity because Flipkart is a client.

Walmart has eyed India for long but has never been able to expand its operations into the business-to-consumer (B2C) space because regulations don’t allow it to do that. (India does not allow foreign ownership in multi-brand, B2C retail and a joint venture with India’s Bharti Group was shuttered after an internal anti-corruption probe.) With Flipkart, Walmart will have access selling directly to Indian consumers. (It is buying into Flipkart, which is a marketplace platform will tens of thousands of sellers. This is permitted by law.)

So far, Walmart was dependent on its wholesale business in India. The second source explains: “92% of Indian retail is unorganised, which Walmart addresses through the cash-and-carry business… because Walmart is selling to kirana stores.” Walmart’s Best Price cash-and-carry business operates in 19 states and turns in revenues of some Rs 4,000 crore.

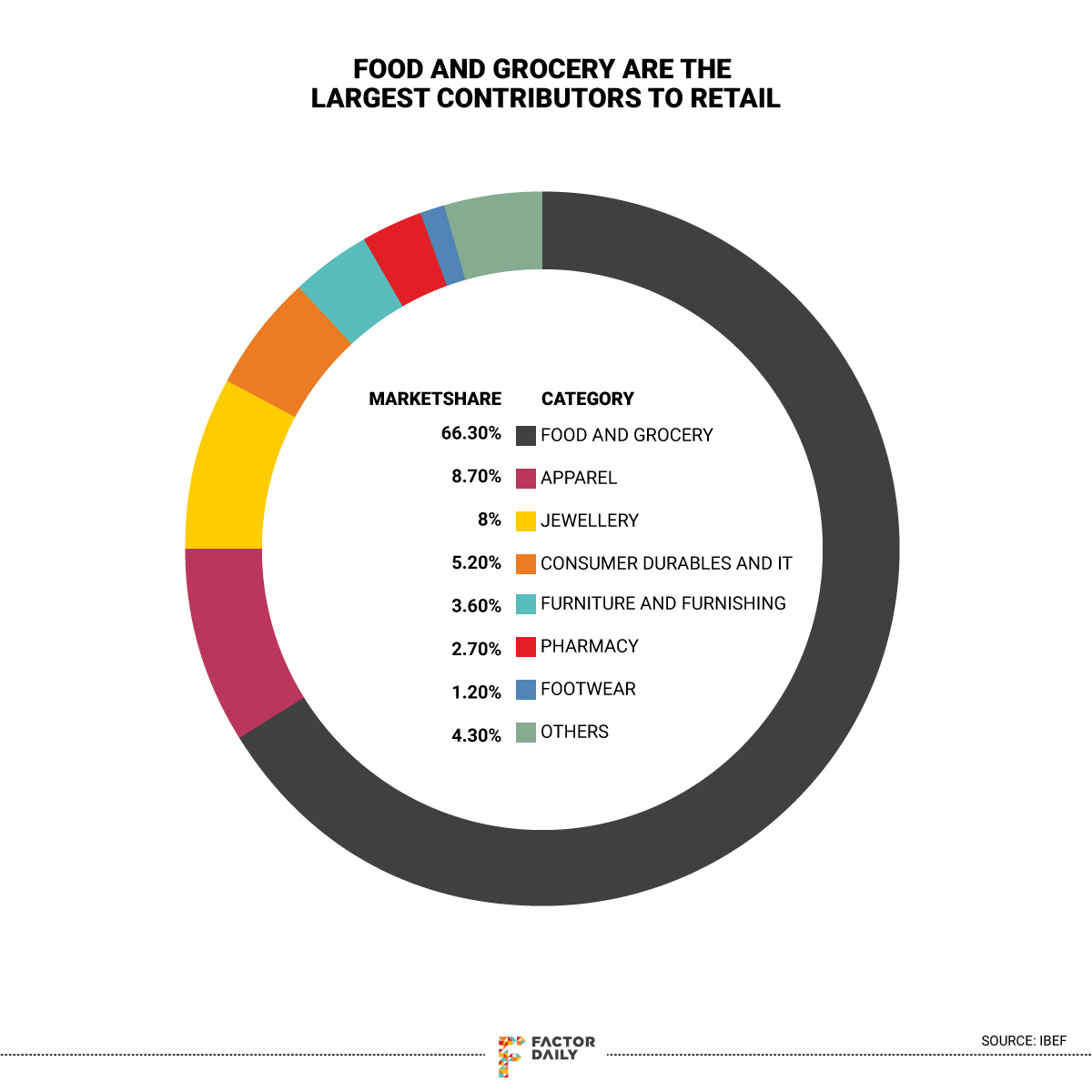

But, Walmart doesn’t have access to the end customer in the last single, large retail market of the world: a market servicing 1.3 billion customers and expected to nearly triple its current size. According to internal estimates of Walmart, by 2027, Indian retail will be a $1.8 trillion market 80% of which still remain unorganised. The remaining 20%, or $360 billion, will be the addressable market for the likes of Reliance Retail, Future Retail, More, Amazon India — and Flipkart.

Flipkart offers scale to Walmart’s India operations. It has 100 million registered users and records more than eight million monthly shipments across Tier-I, Tier-II and Tier-III cities and towns and even rural India.

In doing so, Flipkart has set up the foundation of a business that can be built upon, says an expert. “You need deep pockets to build a consumer-centric company… Flipkart has already spent a lot in the battle against Amazon,” said Raghu Viswanath, founder and managing director of management consulting firm, Vertebrand. Walmart can take advantage of that.

And, then, there’s significant synergy to be had in sellers on the two platforms. “A lot of suppliers who are selling to B2B can sell on Flipkart. The (Walmart) supplier development team can work and scale up the business,” said the second source. Walmart has over 1,000 suppliers in cash-and-carry business and then there are farmers as well.

The same farmer can sell on Flipkart as Walmart deepens its engagement. “Walmart’s core strength is food and grocery. Food and grocery are not big in Flipkart. It is a small pilot,” said the second source. Food and grocery, though items with wafer-thin margins, account for a large part of the consumer basket and modern retailers are all betting on it. Amazon India’s head Amit Agarwal said in a recent interview to Reuters that groceries and consumables would probably account for half of its business in five years.

Walmart plans to bring new supply chain investment in the back end and bring the farmer supplier and SME suppliers in the food chain to build Flipkart’s food and grocery business. “This will not happen overnight… Walmart is looking at this investment as an enabler in this business,” said the second source.

Walmart plans to bring new supply chain investment in the back end and bring the farmer supplier and SME suppliers in the food chain to build Flipkart’s food and grocery business. “This will not happen overnight… Walmart is looking at this investment as an enabler in this business,” said the second source.

“While brick-and-mortar continues to stay, online is a new opportunity… Flipkart helps Walmart get what it has not yet been able to build in India,” said Arvind Singhal, chairman of consultancy firm Technopak.

While the two main reasons for Walmart to invest in Flipkart is that it gets access to a large new customer base and it can use Flipkart to build a large food and grocery business, some of the other benefits are: Flipkart has a large logistics network that Walmart can use for its cash-and-carry business; Walmart gets to ride on Flipkart’s cash-on-delivery operations; and there will be access to data analytics and Indian customer insights that Walmart lacks.

Walmart doesn’t want to miss the chance of giving a tough fight to Amazon in the only large, relatively untapped consumer market outside of the US and China.

In 2010, Walmart bought a 51% stake in China’s No. 3 ecommerce company Yihodian, which had a 10% market share (before acquiring it fully in 2015). The largest player Alibaba had 35% and JD.com had about 15% at the time of the first purchase. By 2015, when Walmart bought out the remaining of Yihodian, its share was down to about 1%. Alibaba and JD were at 50% and 25%, respectively.

“China was very aggressive, but the American retailer ran the China operations like it ran Walmart in the US,” said the third source.

This source adds that Walmart lost its China bet because it failed to match the investments that its rivals there made. “That is why Yihodian got killed,” this source added. To remain a significant player in China, Walmart bought a stake in JD. Walmart is now a seller on JD.com.

In Japan, Walmart controls supermarket chain Seiyu from 2008. It is a seller on Rakuten and recently announced a partnership with the Japanese ecommerce company to launch an online grocery delivery service, Rakuten Seiyu Netsuper. The service is expected to start the second half of this year.

Walmart hasn’t invested heavily in India as well: about $800 million in 10 years to build the cash-and-carry business. As far as technology – the backbone of ecommerce – is concerned, Walmart’s investment has been a tiny fraction of its ecommerce B2B sales in the country.

“But, Walmart feels that it was wrong to go after the No.3 or No. 2 in the market. That’s why it is ready to spend billions in India, on the largest player,” said the second source.

Going after the No.1 comes at a cost. While Amazon has only spent $2.5 billion to $3 billion to become a close No.2 player in the Indian market, Walmart will be spending four to five times that amount to become the largest player. “That makes little financial sense… but having burnt its fingers in China, Walmart wants to go after the No.1 player,” said the first source.

An ex-Walmart senior executive summed it up well: “If you are the world’s largest company (by revenues), how can you not have a presence in India? So, from a strategic point of view, this deal makes a lot of sense. About the price, Walmart has a solid balance sheet and a couple of billions this way or that way won’t make a difference if Indian ecommerce grows the way it is projected.”

An ex-Walmart senior executive summed it up well: “If you are the world’s largest company (by revenues), how can you not have a presence in India? So, from a strategic point of view, this deal makes a lot of sense. About the price, Walmart has a solid balance sheet and a couple of billions this way or that way won’t make a difference if Indian ecommerce grows the way it is projected.”

Growth in the Indian retail market and Flipkart’s ability to ride the India consumer wave, it is clear, are what Walmart is betting on in this deal.